Azarga Metals Signs Definitive Agreement to Acquire Marg Copper-Rich VMS Project In Yukon

AZARGA METALS CORP. ("Azarga Metals" or the “Company”) (TSX-V:AZR) is pleased to announce that it has signed a binding agreement (the “Agreement”) with Golden Predator Mining Corp. (“Golden Predator”) to acquire the Marg copper-rich VMS project (the “Marg Project”), located in Central Yukon. The Agreement supersedes the non-binding term sheet announced on 14 July 2021.

President, CEO and Director, Gordon Tainton, said: “We’re very excited about the Marg Project. Azarga Metal’s technical due diligence has indicated that Marg is a high-grade copper-rich VMS project with significant gold and silver credits. The project has a NI 43-101 resource and a PEA report that was completed in 2016. The positive outlook for base metals and the exploration upside associated with the Project make it a compelling value creating opportunity for Azarga Metals.”

The Company plans to conduct an equity financing to fund an aggressive drill program on the Marg project and announcements will follow in due course regarding the financing arrangements.

ABOUT THE MARG PROJECT

The Marg Project is an undeveloped volcanogenic massive sulphide (“VMS”) deposit located in the Mayo Mining District in Central Yukon, approximately 40 kilometres east of Keno City (which itself is approximately 465 kilometres by road north of Whitehorse). The Marg Project claims are located within the First Nation of the Nacho Nyak Dun (“FNNND”) traditional territory.

Due diligence conducted by Azarga Metals highlights potential areas the Company will focus on initially to enhance the value of the Marg Project, including:

- Advancing metallurgical and mineralogical work – The Company believes that more appropriate and extensive metallurgical and mineralogical test work could deliver improved economic outcomes. The issue of lack of relevant metallurgical and mineralogical test work presented itself in the PEA with lower than typical recoveries assumed for similar mineralization styles (including very low assumed recoveries into concentrate for gold or silver).

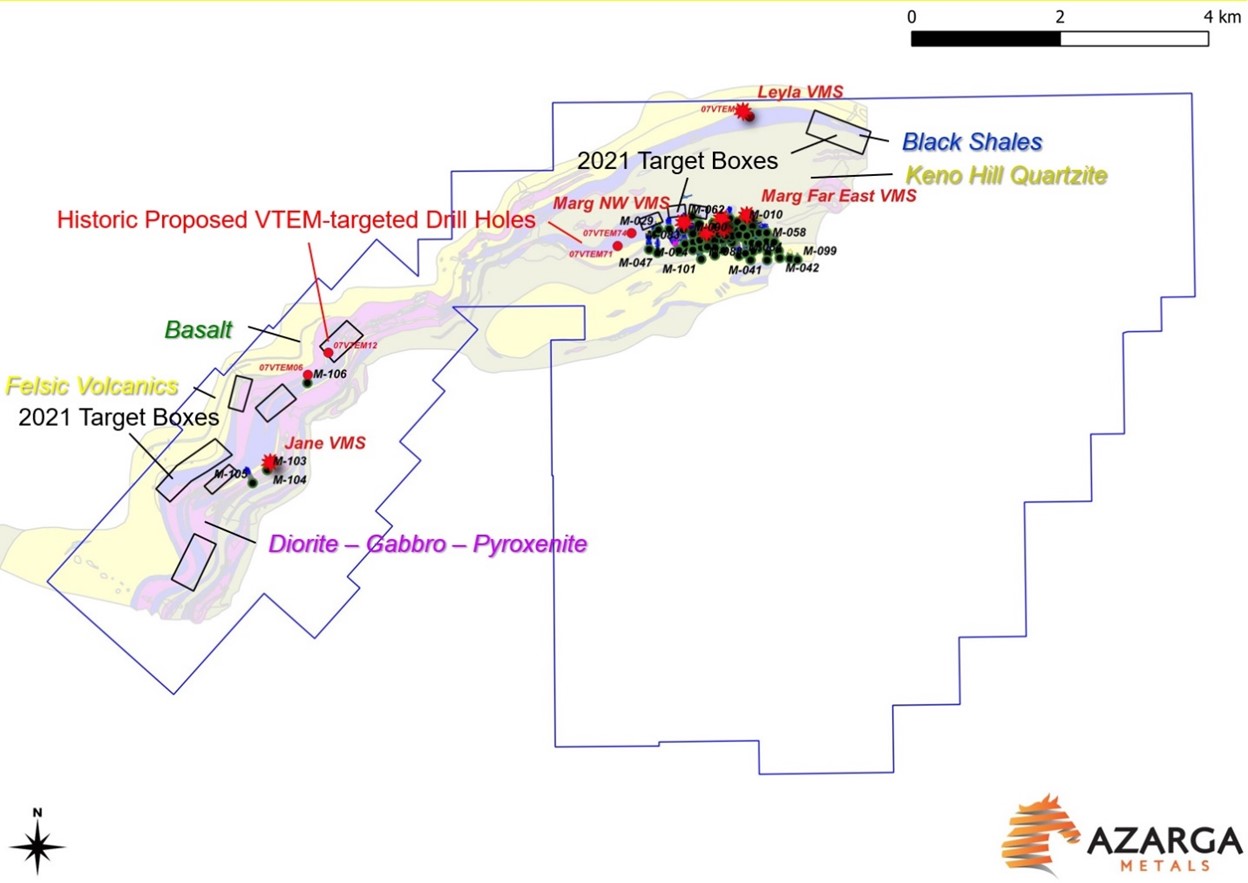

- Analysis and interpretation of 2006 VTEM data (and surface geochemistry) – The Company’s analysis and interpretation of the VTEM Airborne ElectroMagnetic (“AEM”) surveys completed in 2006 over high-priority felsic volcanics have not yet been adequately followed up with detailed additional ground geophysical surveys, soil sampling, geological mapping and/or drilling.

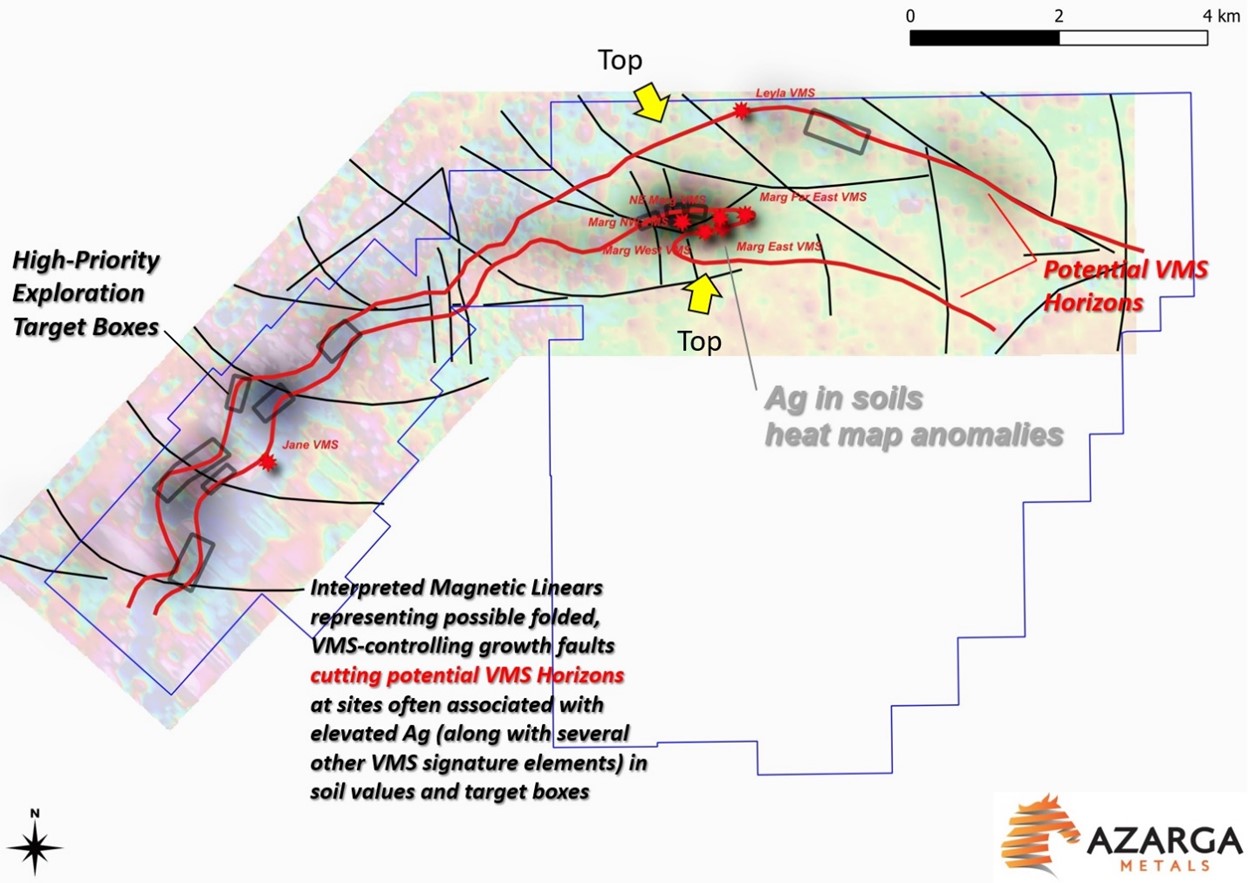

- Modern soil surveys have also outlined a number of excellent, untested, semi-coincident Ag-Pb-Hg-Ba-Mn-Sb-Tl anomalies (“VMS signature”) locally coincident with untested strong VTEM AEM anomalies lying within highly prospective felsic volcanics. As a consequence, there remains considerable exploration upside with the potential to significantly expand the known base and precious metal inventory on the property.

- Analysis of the geological setting of the Marg VMS deposit along with its coincident AEM geophysical and surface geochemical attributes suggest strong potential for additional VMS deposits to occur at regular intervals along strike, especially in an area referred to as the Jane Mineral Occurrence (Yukon Minfile_ID #13663 – located 7 kilometres along strike to the southwest of Marg – see Figure 1).

- Mineralized Envelope extension and exploration – Azarga Metals believes there is strong potential to materially add to mineralization at the Project. Firstly, at Marg itself, deeper drilling is recommended to explore the down-plunge, relatively sparsely drill-tested continuation of two massive sulphide lenses that constitute the bulk of the known Marg mineral resource. Secondly, proposed drilling within three target boxes located immediately northwest of the Marg deposit will be focused on coincident exceptionally strong Ag-Tl-Pb-Cu-Ba in soil anomalies, VTEM AEM conductors and a prospective rhyolite - black shale contact (possibly representing an assumed fold-repeated Marg VMS Horizon with similar geological-geophysical-geochemical attributes), all located within a few hundreds of metres northwest of the historic Marg deposit (Figure 1).

- Initial meetings with the FNNND resulted in a mutual understanding to work together to develop a comprehensive engagement plan, based on Azarga Metals goals and objectives in the spirit of respect, transparency, and partnership. The plan would provide a framework for prioritizing business and training opportunities by Azarga Metals for FNNND individuals, groups and those entities owned by and/or affiliated to FNNND.

Figure 1 – Historic Drill Holes, Target Boxes and Historic Proposed Drill Holes on Geology

As reported in the Company’s July 14th, 2021 news release, the most recent NI43-101 Mineral Resource estimate for Marg (see Table 1) was completed by Mining Plus Canada Consulting Ltd. (“Mining Plus”) in 2016 and incorporated into a Preliminary Economic Assessment (“PEA”) for the Project (note: the PEA title is “Revere Development Corp, Marg Project Preliminary Economic Assessment, Technical Report, Yukon Canada” and is dated 31 August 2016).

Table 1 – 31 August 2016 NI43-101 total Mineral Resource estimate for Marg Project at a 0.5% copper equivalent cut-off (combining high-grade and low-grade zones)1

| Category | Tonnage (mt) | Cu% | Pb% | Zn% | Ag g/t | Au g/t |

| Indicated | 3.7 | 1.5 | 2.0 | 3.8 | 48 | 0.76 |

| Inferred | 6.1 | 1.2 | 1.7 | 3.4 | 44 | 0.74 |

Note: 1. Where CuEq% was calculated = Cu% + 0.28 Pb% + 0.32 Zn% + 0.39 Au g/t + 0.0055 Ag g/t, which was assessed based on the following metal price and recovery assumptions: Cu price of 2.5 US$/lb and recovery of 80% (96.5% payable); Pb price of 0.8 US$/lb and recovery of 70% (95% payable); Zn price of 0.8 US$/lb and recovery of 90% (85% payable); Au price of 1100 US$/oz and recovery of 50% (90% payable); and Ag price of 16 US$/oz and recovery of 50% (90% payable).

The Marg deposit was first identified in 1965 by strong regional stream sediment geochemical anomalies detected as part of a Geological Survey of Canada study. Since then, Marg has been developed into a sizeable VMS deposit. To this effect, the potential for discovering an analogous VMS deposit seems quite reasonable in the Jane Area (7 kilometres to the southwest) where somewhat similar surface geochemical anomalies (namely Ag in soil and/or stream sediment anomalies) are present within favourable host rocks (Figure 2).

Figure 2 – Potential VMS Horizons, Target Boxes and Ag in Soils Heat Map on VTEM Magnetics

THE AGREEMENT

Azarga Metals has executed the Agreement with Golden Predator. On closing Azarga Metals will issue 5,219,985 common shares in Azarga Metals, at a deemed price of $0.134 per share for a total deemed value of $700,000. Staged cash payments of $200,000 at the one-year anniversary date of closing; $350,000 at the two-year anniversary date of closing for the completion of the Transaction; and a milestone payment of $300,000 (in cash or shares at Golden Predators discretion) upon final decision to mine by Azarga Metals at the Marg Project.

Golden Predator will be entitled to a 1% NSR royalty of all metals extracted from the Marg Project. Azarga Metals will have the option to buy back 100% of the NSR for cash consideration of $1,500,000.

The Company has received the appropriate consent and waiver under the existing Baker Steel Resources Trust convertible loan.

A finder’s fee for the first payment will be settled on closing by the issue of 447,761 common shares at a deemed price of $0.134 per share for a total deemed value of $60,000. The finder’s fee agreement is in accordance with the policies of the TSX Venture Exchange (the “Exchange”) will be settled in cash or in shares at the Company’s discretion.

All common shares issued in connection with the Agreement and the finder’s fee will be subject to a four-month and a day hold period. The Agreement is subject to the approval of the TSX Venture Exchange.

Qualified Person

James Pickell, P.Geo., a consultant to Azarga Metals and a Qualified Person as defined by NI 43-101, verified the data disclosed and has reviewed and approved the disclosure contained in this Press Release.

About Azarga Metals Corp.

Azarga Metals is a mineral exploration and development company that owns 100% of the Unkur Copper-Silver Project in the Zabaikalsky administrative region in eastern Russia. On completion of a first phase physical exploration program in 2016-2018, the Company estimated an Inferred Resource of 62 million tonnes at 0.53% copper and 38.6g/t silver for the project in the report entitled “Technical Report and Preliminary Economic Assessment for the Unkur Copper-Silver Project, Kodar-Udokan, Russian Federation” dated effective August 30, 2018 authored by Tetra Tech Mining & Minerals. The Resource remains open in both directions along strike and down-dip.

AZARGA METALS CORP.

"Gordon Tainton"

Gordon Tainton,

President and Chief Executive Officer

For further information please contact Doris Meyer, at +1 604 536-2711 ext. 3, or Gordon Tainton, at + 1-604-248-8380 or visit www.azargametals.com or follow us on Twitter @AzargaMetals. The address of the head office of Azarga Metals is Unit 1 - 15782 Marine Drive, White Rock, BC V4B 1E6, British Columbia, Canada.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement:

This news release contains forward-looking statements that are based on the Corporation's current expectations and estimates. Forward-looking statements are frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "suggest", "indicate" and other similar words or statements that certain events or conditions "may" or "will" occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such factors include, among others: the actual results of current planned exploration activities; conclusions of economic evaluations; changes in project parameters as plans to continue to be refined; possible variations in mineralization grade or recovery rates; accidents, labor disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; and fluctuations in metal prices. There may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Forward-looking statements are not a guarantee of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.