Acquisition of 60% of Large Scale Unkur Copper-Silver Project in Russia and C$2.0M Fundraising

Highlights:

- Agreement to initially acquire 60% of Unkur Copper-Silver Project in eastern Russia, with the ability to acquire the remaining 40% in the future

- Project hosts a large, shallow sediment-hosted stratiform copper-silver deposit

- Significant results from limited historical drilling include:

- 21.0m at 5.9% copper

- 20.0m at 4.2% copper

- 12.0m at 3.3% copper

- 12.0m at 2.3% copper

- 3.3m at 3.3% copper

- 3.2m at 3.3% copper

- Composite samples from mineralized core duplicates contained silver at an average grade of 67.4g/t, with a low of 11.2g/t and a high of 164.6g/t (note: composite samples are selective samples and are not representative of the mineralization hosted on the property)

- High exploration potential:

- Copper-silver bearing horizon has been identified >4,500 meters of strike

- Maximum historical drill hole intersection depth is <300 meters

- Multiple drill-ready targets

- Historical work leaves open the extent of the mineral bearing horizon both along strike and down dip

- Metallurgical recoveries up to approximately 96% for both copper and silver based on recent preliminary test work

- Excellent location, access and infrastructure, including:

- Less than 400 kilometers to China-Russia border

- Approximately 7 kilometers from railway and road

- High-voltage electrical substation within 25 kilometers and power line at license area

- C$2.0M fundraising, with C$1.5M committed under executed subscription agreements

Dorian (Dusty) Nicol, President and Chief Executive Officer stated: "This acquisition will allow the Company to proceed with exploration of an exciting new copper and silver project in a favourable location. We are preparing to conduct our first drilling program at Unkur in the fall of this year." He then went on to say: "With our low overhead cost and current low cost of drilling in Russia, we currently anticipate the fundraising to sustain active exploration at the project for a period in excess of two-years."

UNKUR COPPER-SILVER PROJECT

Sediment-hosted copper and silver mineralization has been identified across the 5,390 hectare Unkur Project license area, in outcrops, trenches and by diamond drilling over a strike length of approximately five kilometers.

Diamond drilling was conducted at the Unkur Project in 1971 and 1978, with eight holes intersecting high-quality copper mineralization. The deepest mineralized intersection was at a relatively shallow down hole depth of 242.4 meters.

Limited work has been undertaken on the Unkur Project since the late-1970s.

The Unkur Project was successfully acquired through a Russian Government public tender by Azarga Metals Limited ("Azarga Metals") following extensive preparatory work by that organization including data collation and prospecting at the site over a period in excess of three years.

The current mineral license for the Unkur Project covers mining of copper, silver and associated metals and is valid until the end 2039.

Given extensive historical geophysics and some drilling, EUU management considers the Unkur Project a drill ready project that is highly prospective for the delineation of a shallow deposit of substantial copper mineralization with associated economically important grades of silver.

The Company believes there is good potential to delineate a substantial economically viable copper-silver deposit at the Unkur Project. EUU's initial target is for the delineation of 20-40 million tonnes of mineralization at 0.6-0.9% copper and 60-80g/t silver. The geological style of this type of sediment hosted copper deposit around the world is known to have potential to host hundreds of millions of tonnes of mineralization. In line with this, management believes there is potential to discover a very large deposit within the Unkur Project license area. It should be noted with respect to the Company's initial target that the potential quantity and grade is conceptual in nature, that there has been insufficient exploration to define a mineral resource and that it is uncertain if further exploration will result in the target being delineated as a mineral resource.

Location and access

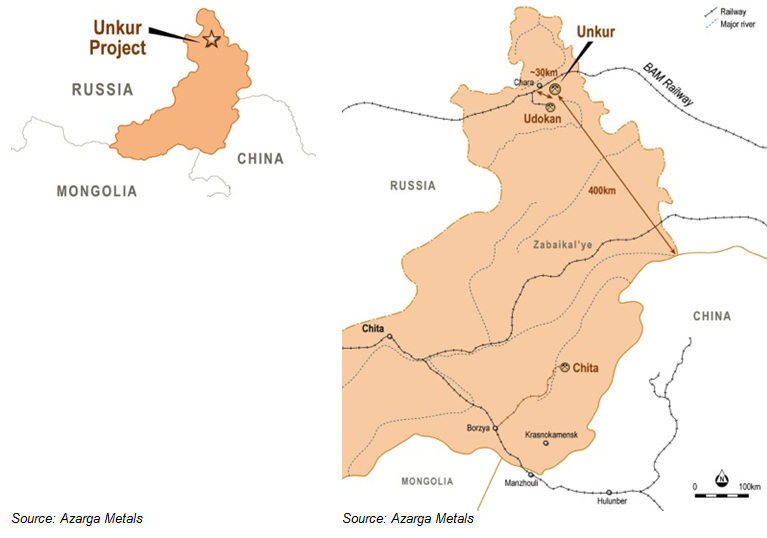

The Unkur Project consists of one 5,390 hectare license that lies in the Kalarsky district of the Zabaikalsky administrative region of Russia, approximately 380 kilometers north of the China-Russia border and 15 kilometers to the east of Novaya Chara town.

The Baikal-Amur Mainline ("BAM") railway passes within approximately seven kilometers of the Unkur Project and Novaya Chara is approximately 22 kilometers along the year-round natural road beside the railway. The town of Chara, where there is an operating commercial airport, is approximately 33 kilometers from the project area.

Railway routes directly connected to the BAM railway provide access to China and also Russia's far eastern ports on the Pacific coast.

A power line crosses over the Unkur Project license area connecting to a high-voltage sub-station at Novaya Chara with a capacity of 200 megawatts.

The Unkur Project sits in a broader district known for its copper and precious metals mineralization. It is within 20 kilometers of Udokan, which is reportedly one of the three largest undeveloped copper deposits in the world today.

Zabaikalsky administrative region Unkur, local geography and infrastructure

History

Copper mineralization was first discovered at the Unkur Project in 1962. The vast majority of recorded exploration at the project occurred between 1969 and 1978. The work in this period included approximately 6,700 cumulative linear meters of diamond core drilling undertaken in 1971 and 1978, and almost 40,000 cumulative cubic meters of trenching.

Eight drill holes intersected high-quality copper mineralization. The deepest mineralized intersection was at a relatively shallow down hole depth of 242.4 meters.

Significant drilling results include:

- 21.0m at 5.9% copper

- 20.0m at 4.2% copper

- 12.0m at 3.3% copper

- 12.0m at 2.3% copper

- 3.3m at 3.3% copper

- 3.2m at 3.3% copper

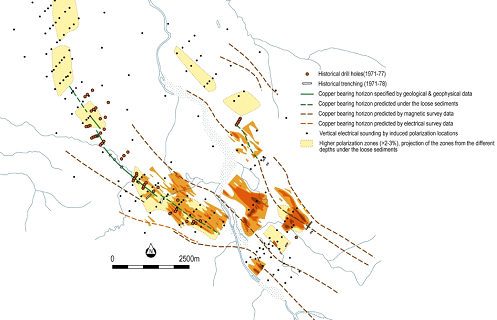

Ground geophysical surveys were carried out in two major campaigns at the Unkur Project. Methods included electric logging (induced polarization, dipole electric profiling), time-variable natural magnetic field, magnetic and gravity survey. Data cross-referenced with outcrop samples and drill hole core determined that the geological unit under the copper-bearing horizon was highly pyritized and this became a geophysical marker for identifying the copper-bearing horizon. The survey data showed that zones of conductivity and high polarizability are confined to the horizons of copper-bearing sandstones.

Historical exploration and location of copper bearing horizons

No meaningful exploration activity has taken place on the Unkur Project since 1978. However, in 2013, Azarga Metals's technical team confirmed the presence of copper-silver mineralization through five rock chip samples taken at the site, which tested 1.8% to 6.1% copper and 49g/t to 230g/t silver.

Azarga Metals acquired the Unkur Project in mid-2014 and subsequently performed additional surface prospecting and a technical review. In early 2015 a 350 kilogram sample of near-surface oxidized ore was collected for metallurgical testing by SGS Vostock (a member of the SGS Group).

Geology

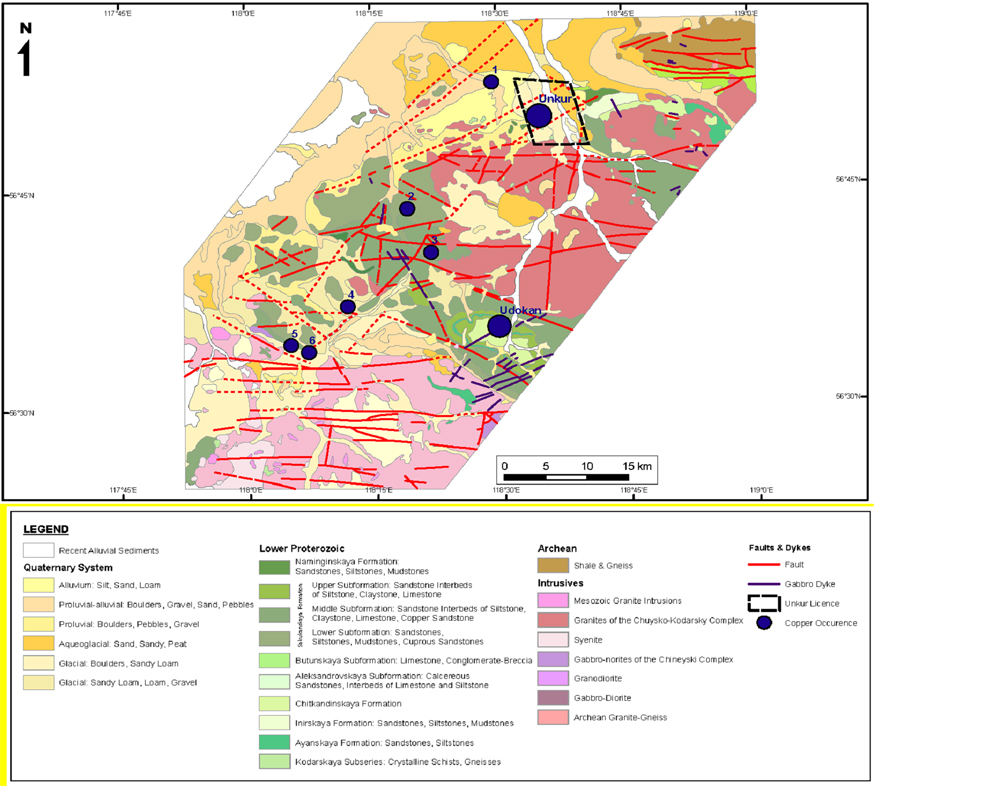

The Unkur Project is situated on the southern Siberian platform in the Kodar-Udokan structural zone. Locally, the geology is composed of Lower Proterozoic metamorphosed sediments of the Udokan Series, Lower Proterozoic granitoids of the Chuisko-Kodarsly complex, gabbroid massifs and dykes of Late Proterozoic gabbroids of the Chiney complex, and Quaternary alluvial and glacial cover.

The sediments of the Udokan series were deposited in a shallow marine environment. In ascending stratigraphic order, the formations of the series are named as the Ikabyinskaya, Inyrskaya, Chitkandinskaya, Alexandrovskaya, Butunskaya, and Sakukanskaya. The overall thickness of the series is 5,350m.

The copper-bearing horizon is confined to sediments of the Lower subformation of the Sakukanskaya formation. This subformation is a 500 meters thick package of alternating pinkish-grey medium-grained sandstones and grey to black siltstones.

Regional geology

Source: Technical Report for the Unkur Copper-Silver Deposit, Kodar-Udokan Area, Russian Federation, SRK Consulting (Russia) Ltd., February 2015

The Unkur deposit is interpreted as a sediment-hosted stratiform copper deposit. The copper-bearing horizon was initially identified and traced in the south-western limb of a syncline known as the Unkur syncline. The position of the copper-bearing horizon is 80-100 meters above the base of the Sakukanskaya formation.

The copper-bearing horizon has been traced along the strike for 4.6 kilometers, including a 3 kilometer length of drill hole and trench intersections. The maximum drill hole intersection depth is approximately 240 meters. The thickness of the horizon ranges from 12-50 meters.

From geophysical methods, the copper-bearing horizon has been traced under moraine sediments for 4 kilometers and is characterized by high polarizability. Geophysical results and the presence of copper oxide minerals among deluvial sediments are a possible indicator of the location of the horizon on the northeast limb of the Unkur syncline where limited drilling and trenching has taken place.

Primary copper minerals are chalcopyrite, pyrite, bornite, magnetite, hematite; accessory minerals are chalcocite and ilmenite. The oxide minerals present are malachite, brochantite and covellite. A hypogene zonation is noted in the distribution of the copper minerals: a chalcopyrite-pyrite-bornite association is found in the centre; either side of this there is a monomineral chalcopyrite association, and then a distal pyrite association at the edges of the mineralized zone.

The oxidised zone is poorly developed, to a depth of 5-10 meters from surface. Copper oxide minerals are also observed at deeper levels in fractured zones.

The mineralized zone is displaced by northeast-striking fault and breccia zones. The displacements are typically 20-70 meters, but for some faults displacements are as much as 150 meters.

Below the copper-bearing horizon are pyritized calcareous sandstones and siltstones; above the horizon are sandstones and siltstones of the upper part of the Lower Sakukanskaya subformation.

Metallurgy

In early 2015 a 350 kilogram sample of near-surface copper oxide ore was collected from the Unkur Project for metallurgical test work and sent to SGS Vostok (a member of the SGS Group). The grade of the sample averaged 1.31% copper and 28.2g/t silver. Hydrometallurgical processing allowed copper recovery of 95.9-98.4% and recovery of silver into cyanide solution was 96%.

Qualified Person

The scientific and technical disclosure in this news release was reviewed and approved by Dorian (Dusty) Nicol, the Company's President and CEO and a Qualified Person as defined in NI 43-101.

UNKUR ACQUISITION TERMS

On March 1, 2016, the Company and Azarga Metals executed a share purchase agreement whereby the six shareholders of Azarga Metals (the "Selling Shareholders") will immediately sell 60% of the issued shares of Azarga Metals to EUU in exchange for shares of EUU and deferred cash payments. Subject to terms and conditions, the Selling Shareholders have agreed to grant EUU the right to purchase the remaining 40% of the shares of Azarga Metals (the "Call") and EUU has granted the Azarga Metals Selling Shareholders the right to sell the remaining 40% of the shares of Azarga Metals to it (the "Put"). The fair value of that 40% interest will be negotiated at the time of exercise.

Azarga Metals (BVI) owns 100% of the issued shares of Shilka Metals LLC (Cyprus) which in turn owns 100% of the issued capital of Tuva-Kobalt (Russia). Tuva-Kobalt was awarded the Unkur mineral exploration and exploitation license via a bidding process on August 26, 2014 and is valid through December 31, 2039.

On closing EUU will issue the Selling Shareholders 15,776,181 common shares, which will be approximately 37% of the number of shares as constituted after closing the transaction, the Private Placement, the Debt Settlement and the Consolidation (the "Consideration Shares"). In exchange for the Consideration Shares, the Selling Shareholders will transfer 60% of the issued shares of Azarga Metals to EUU. The Consideration Shares will be restricted from trading for two years from issue date. EUU will be assigned existing loans made by the Selling Shareholders to Azarga Metals of up to US$800,000 that bear interest at the rate of 12% per annum, which can be capitalized or paid in cash (the "Debt"). The Debt must be paid within seven years from closing. The Selling Shareholders will retain a 5% net smelter return royalty ("NSR") and their combined 40% interest in Azarga Metals will be free carried to initial production and profitability subject to the Put/Call Options. EUU will have the right to buy back up to 2% of the NSR at a cost of US$5 million per percentage point so that upon paying US$10 million the NSR will be reduced to 3%. In addition EUU will make deferred cash payments to the Selling Shareholders of US$1,680,000 (the "Deferred Cash Payments") beginning with US$80,000 payable on 1 June 2017, with a payment on each annual anniversary that increases by US$80,000 a year so that the final payment of US$480,000 will be due on 1 June 2022. In the event of a change of control of EUU, the Debt and Deferred Cash Payments will become due and payable within five days.

EUU has undertaken to spend a minimum of US$3,000,000 on exploration activities on the Unkur Project prior to 30 June 2019, and an additional US$6,000,000 between 1 July 2019 and 30 June 2023.

If at any time, a Resource (adding Measured, Indicated and Inferred of all combined deposits within the Unkur Project area) is estimated to contain copper and silver to the equivalent of 2 million tonnes or more of copper where Measured plus Indicated Resources comprise at least 70% of that estimate, taking the value of silver as copper equivalent (the "Bonus Payment Threshold"), an additional US$6,200,000 will be payable to the Selling Shareholders within 12-months notice that the Bonus Payment Threshold has been met.

Three of the selling shareholders of Azarga Metals have agreed to loan EUU up to C$100,000 with a 12-month term and interest at the rate of 15% per annum to facilitate the various transactions.

Closing the Unkur Acquisition is subject to closing the Private Placement and Share Consolidation. The Unkur Acquisition is arm's length and there is no finder's fee. The Unkur Acquisition has been classified as a fundamental acquisition under the rules of the TSX Venture Exchange (the "Exchange").

To support the application for approval with the Exchange, the Company will provide an independently prepared Geological Report on the Unkur Project. It is expected that this report will recommend a first phase drill program at the Unkur Project with an estimated budget of US$450,000 to US$500,000.

SHARE CONSOLIDATION AND NAME CHANGE

The Board of Directors plan to change the name of the Company to Azarga Metals Corp. and to consolidate the Company's shares on a 1 new for up to 10 old basis.

Management of the Company believes that the share consolidation is necessary and integral to implement its plans pursuant to the transactions outlined. There are currently 65,942,653 shares outstanding and if the consolidation of 1 new for 10 old is completed, there would be 6,594,265 common shares outstanding before closing of the Unkur Acquisition, the Private Placement and Debt Settlement common share issues.

PRIVATE PLACEMENT

To fund anticipated exploration, the Company will undertake a non-brokered Private Placement of a minimum of 20,000,000 post-consolidated shares at an issue price of C$0.10 per share. Subscription agreements have been executed for 15,000,000 shares and those funds will be received and held in escrow prior to closing. The Private Placement is conditional on completion of the successful completion of the Unkur Acquisition and Share Consolidation.

The Private Placement is subject to compliance with applicable securities laws and to receipt of regulatory approval. The Company reserves the right to modify the type, nature and/or price of the Private Placement for any reason, subject to Exchange acceptance.

The Company may pay finder's fees within the allowable limits of the policies of the Exchange.

SETTLEMENT OF EXISTING EUU DEBTS

The Company has reached settlement agreements with certain current and past related parties to fully settle an aggregate of C$550,104 debt recorded in the books of the Company by a write-off of C$490,791 of those debts, approximately 89%, and the issue of an aggregate of 593,131 post-consolidated common shares at C$0.10 per share for the remainder of $59,313.

POST-COMPLETION BOARD AND MANAGEMENT CHANGES

On closing the Unkur Acquisition, Dorian (Dusty) Nicol will remain as a director and President and CEO to lead the Company into its next evolution and Michael Hopley will remain as a director. On 29 February 2016, Doris Meyer was appointed to the role of Chief Financial Officer in addition to her role as Corporate Secretary. She will remain in both roles on closing. However, two of EUU's current directors, David Montgomery and David (Sam) Hutchins, will resign to be replaced by two Azarga Metals' nominees. Subject to Exchange approval, the two proposed new directors are:

- Alexander Molyneux -- Mr. Molyneux is an experienced Asia-based natural resources industry executive. He currently serves as CEO of the world's second largest publicly listed uranium producer, Paladin Energy Limited (TSX: PDN / ASX: PDN). Mr. Molyneux is Co-Founder of Azarga Resources Group and Co-Founder and Chairman of Azarga Metals. He was previously President, CEO and Director of SouthGobi Resources (TSX: SGQ, HKEX: 1878) (2009 -- 2012) and continues to serve as Non-Executive Director of Goldrock Mines Corp. (2012 -- present). Prior to joining SouthGobi, Mr. Molyneux had a 10-year career as a natural resources investment banker. Mr. Molyneux holds a Bachelor degree in Economics from Monash University in Australia.

- Vladimir Pakhomov -- Mr. Pakhomov is a Co-Founder and Director of Azarga Metals. He Co-Founded Olympia Capital, an asset management and merchant banking firm specializing in Russia and CIS country opportunities, in 2011 and continues as its Managing Partner. Prior to this, he was Director of Investments at Onexim Group (Russia), where he was responsible for a number of major investments and represented the Group on the Boards of Directors of Renaissance Capital, Quadra Generation, RBC InfoSystems and Soglasie Insurance. Prior to Onexim, Mr. Pakhomov held various roles at Aquila Capital and within Alfa Bank's mergers and acquisitions group. Over his career Mr. Pakhomov was involved in various Russia and CIS country transactions worth more than US$10 billion. He graduated magna cum laude from Moscow Institute of International Relations and is a CFA Charterholder.

The Company wishes its departing directors all the best and thanks them for their many years of combined service. It also believes the management structure will combine the right mix of keeping overheads low whilst employing the expertise to succeed in Russia and with the Unkur Project specifically.

KEY CONDITIONS TO CLOSING

The parties' obligations to complete the various transactions are subject to Exchange approval of all elements of these transactions on terms acceptable to the parties, and settlement of formal documentation: the closing of all of the transactions is each conditional on the closing of the other.

KEY DATES

March 1, 2016 Share Purchase Agreement executed

April 30, 2016 Shareholder meeting if required

May 9, 2016 Consolidation, Closing of Private Placement, Share Purchase Agreement and Debt Settlement

PRO-FORMA SHARE STRUCTURE

The following table sets out the indicative pro-forma share structure for the Company after all of the transactions are completed.

| Number of common shares | |||

| Existing common shares on issue | 65,942,653 | ||

| Common shares post 10:1 consolidation | 6,594,265 | ||

| New shares issued: | |||

| - Unkur Acquisition (to Selling Shareholders) | 15,776,181 | ||

| - Private Placement | 20,000,000 | ||

| - Settlement of existing EUU debts | 593,131 | ||

| Total post-transactions common shares | 42,963,577 |

EUROPEAN URANIUM RESOURCES LTD.

"Dusty Nicol"

Dorian L. (Dusty) Nicol, President and CEO

For further information please contact: Doris Meyer, at (604) 536-2711 ext 6, or visitwww.euresources.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement:

This news release contains forward-looking statements that are based on the Corporation's current expectations and estimates. Forward-looking statements are frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "suggest", "indicate" and other similar words or statements that certain events or conditions "may" or "will" occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such factors include, among others: the actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans to continue to be refined; possible variations in ore grade or recovery rates; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; and fluctuations in metal prices. There may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Corporation disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.